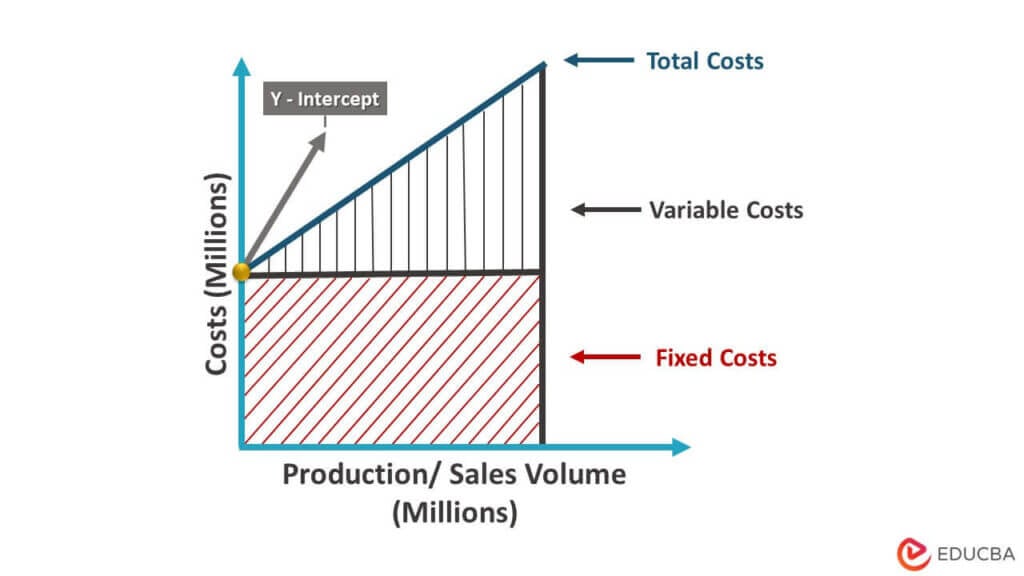

What Items Are Considered Fixed Cost . a fixed cost is necessary for calculating the average fixed cost and total fixed cost. a fixed cost is a business expense that does not vary even if the level of production or sales changes. fixed costs (or constant costs) are costs that are not affected by an increase or decrease in production. fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production volumes. These can be contrasted with. fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. common fixed expenses include: These elements can help companies: That is to say, fixed costs remain. They can be be used when calculating. Many of the costs incurred by a business are fixed costs. examples of fixed costs.

from www.educba.com

That is to say, fixed costs remain. a fixed cost is a business expense that does not vary even if the level of production or sales changes. They can be be used when calculating. a fixed cost is necessary for calculating the average fixed cost and total fixed cost. These can be contrasted with. These elements can help companies: Many of the costs incurred by a business are fixed costs. fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production volumes. examples of fixed costs.

What is Fixed Cost? Formula & Examples Advantages & Disadvantages

What Items Are Considered Fixed Cost These elements can help companies: These elements can help companies: fixed costs (or constant costs) are costs that are not affected by an increase or decrease in production. a fixed cost is necessary for calculating the average fixed cost and total fixed cost. a fixed cost is a business expense that does not vary even if the level of production or sales changes. fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. examples of fixed costs. These can be contrasted with. They can be be used when calculating. common fixed expenses include: That is to say, fixed costs remain. fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production volumes. Many of the costs incurred by a business are fixed costs.

From www.slideserve.com

PPT Chapter 10Continued PowerPoint Presentation, free download ID What Items Are Considered Fixed Cost These elements can help companies: These can be contrasted with. They can be be used when calculating. a fixed cost is a business expense that does not vary even if the level of production or sales changes. common fixed expenses include: fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production volumes. Many. What Items Are Considered Fixed Cost.

From amplitudemktg.com

Fixed Cost What It Is & How to Calculate It Amplitude Marketing What Items Are Considered Fixed Cost a fixed cost is necessary for calculating the average fixed cost and total fixed cost. examples of fixed costs. These can be contrasted with. fixed costs (or constant costs) are costs that are not affected by an increase or decrease in production. fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production. What Items Are Considered Fixed Cost.

From efinancemanagement.com

Fixed Cost What It Is And What's Its Importance? What Items Are Considered Fixed Cost They can be be used when calculating. a fixed cost is a business expense that does not vary even if the level of production or sales changes. These elements can help companies: a fixed cost is necessary for calculating the average fixed cost and total fixed cost. That is to say, fixed costs remain. fixed costs are. What Items Are Considered Fixed Cost.

From www.business-literacy.com

Fixed Costs Business Literacy Institute Financial Intelligence What Items Are Considered Fixed Cost fixed costs (or constant costs) are costs that are not affected by an increase or decrease in production. common fixed expenses include: a fixed cost is a business expense that does not vary even if the level of production or sales changes. a fixed cost is necessary for calculating the average fixed cost and total fixed. What Items Are Considered Fixed Cost.

From dakotakruwli.blogspot.com

Explain the Difference Between Fixed Costs and Variable Costs What Items Are Considered Fixed Cost a fixed cost is necessary for calculating the average fixed cost and total fixed cost. These can be contrasted with. fixed costs (or constant costs) are costs that are not affected by an increase or decrease in production. examples of fixed costs. fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production. What Items Are Considered Fixed Cost.

From dxopaigqt.blob.core.windows.net

Example Of Business Fixed Expenses at Janita Waller blog What Items Are Considered Fixed Cost Many of the costs incurred by a business are fixed costs. They can be be used when calculating. a fixed cost is a business expense that does not vary even if the level of production or sales changes. a fixed cost is necessary for calculating the average fixed cost and total fixed cost. fixed costs are expenses. What Items Are Considered Fixed Cost.

From amplitudemktg.com

Fixed Cost What It Is & How to Calculate It Amplitude Marketing What Items Are Considered Fixed Cost common fixed expenses include: a fixed cost is necessary for calculating the average fixed cost and total fixed cost. That is to say, fixed costs remain. fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. These elements can help companies: These can be contrasted with. examples. What Items Are Considered Fixed Cost.

From napkinfinance.com

What is Fixed Cost vs. Variable Cost? Napkin Finance What Items Are Considered Fixed Cost fixed costs (or constant costs) are costs that are not affected by an increase or decrease in production. examples of fixed costs. These elements can help companies: They can be be used when calculating. a fixed cost is a business expense that does not vary even if the level of production or sales changes. common fixed. What Items Are Considered Fixed Cost.

From dxonotyey.blob.core.windows.net

Fixed Cost And Variable Cost Exercises at Craig Estrada blog What Items Are Considered Fixed Cost common fixed expenses include: These elements can help companies: They can be be used when calculating. fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. a fixed cost is a business expense that does not vary even if the level of production or sales changes. examples. What Items Are Considered Fixed Cost.

From www.1099cafe.com

What is a Fixed Cost Variable vs Fixed Expenses — 1099 Cafe What Items Are Considered Fixed Cost common fixed expenses include: These can be contrasted with. fixed costs (or constant costs) are costs that are not affected by an increase or decrease in production. a fixed cost is a business expense that does not vary even if the level of production or sales changes. They can be be used when calculating. That is to. What Items Are Considered Fixed Cost.

From exosnquyu.blob.core.windows.net

Fixed Expenses Business at Lorraine Hood blog What Items Are Considered Fixed Cost That is to say, fixed costs remain. a fixed cost is a business expense that does not vary even if the level of production or sales changes. examples of fixed costs. common fixed expenses include: These can be contrasted with. They can be be used when calculating. fixed costs are business expenditures that aren't affected by. What Items Are Considered Fixed Cost.

From riable.com

Fixed Costs Riable What Items Are Considered Fixed Cost fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production volumes. They can be be used when calculating. These can be contrasted with. These elements can help companies: Many of the costs incurred by a business are fixed costs. examples of fixed costs. That is to say, fixed costs remain. a fixed cost. What Items Are Considered Fixed Cost.

From efinancemanagement.com

Types of Costs Direct & Indirect Costs Fixed & Variable Costs eFM What Items Are Considered Fixed Cost Many of the costs incurred by a business are fixed costs. That is to say, fixed costs remain. These elements can help companies: common fixed expenses include: examples of fixed costs. fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production volumes. They can be be used when calculating. fixed costs are. What Items Are Considered Fixed Cost.

From www.akounto.com

Fixed vs. Variable Cost Differences & Examples Akounto What Items Are Considered Fixed Cost That is to say, fixed costs remain. fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production volumes. examples of fixed costs. common fixed expenses include: These can be contrasted with. fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. These elements. What Items Are Considered Fixed Cost.

From sendpulse.com

What is an Average Fixed Cost Basics SendPulse What Items Are Considered Fixed Cost fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. a fixed cost is necessary for calculating the average fixed cost and total fixed cost. Many of the costs incurred by a business are fixed costs. common fixed expenses include: These can be contrasted with. They can be. What Items Are Considered Fixed Cost.

From www.slideserve.com

PPT Cost classification PowerPoint Presentation, free download ID What Items Are Considered Fixed Cost They can be be used when calculating. common fixed expenses include: fixed costs (or constant costs) are costs that are not affected by an increase or decrease in production. examples of fixed costs. These can be contrasted with. These elements can help companies: a fixed cost is a business expense that does not vary even if. What Items Are Considered Fixed Cost.

From agiled.app

Differences Between Fixed Cost and Variable Cost What Items Are Considered Fixed Cost examples of fixed costs. That is to say, fixed costs remain. fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. Many of the costs incurred by a business are fixed costs. a fixed cost is necessary for calculating the average fixed cost and total fixed cost. These. What Items Are Considered Fixed Cost.

From stock.adobe.com

Fixed cost and variable cost graph. Clipart image What Items Are Considered Fixed Cost fixed costs are business expenditures that aren't affected by sales, strategic initiatives or production volumes. They can be be used when calculating. examples of fixed costs. common fixed expenses include: Many of the costs incurred by a business are fixed costs. fixed costs are expenses that do not change with increases or decreases in a company’s. What Items Are Considered Fixed Cost.